If you mention the words 'Quicken for Mac' around financially savvy consumers, chances are you'll hear a lot of groans. That's been the consensus for this program over the years. While it might not stack up to the Windows version quite yet, there are improvements you may want to see.

Best Buy has honest and unbiased customer reviews for Quicken Starter 2019 - Mac Windows. Read helpful reviews from our customers. Quicken 2017 free download - Quicken Certificate Updater, PDF2Office for iWork 2017, FlyWings Flight Simulator 2017, and many more programs. In Quicken for Windows I had bonds at $1/share rather than 'Quicken Shares' (I entered a $1000 bond as 1000, not 10 Quicken Shares). Import into Quicken for Mac messed everything up - I had to edit all purchases, sales, and bond prices, for all my history in order to make reports look correct.

Quicken set out to create a program that was at least comparable to its sibling, Quicken for Windows. Did it accomplish that goal? Many users don't think so, but they do recognize the improvements made in the program. Some of the most important improvements made include:

- A more user-friendly interface

- More cohesiveness between mobile app and Quicken for Mac

- More reporting options

Did Quicken accomplish what they set out to do? Keep reading to find out.

How Does Quicken for Mac Work?

One thing you should understand about Quicken for Mac: just likes its Windows counterpart, you must subscribe to the service. The subscriptions are available in one and two-year increments. This means every year (or two years), you must renew your subscription. Quicken offers three versions for Mac users:

- Starter: As the name suggests, it's a starter program, good for those who have never officially budgeted their finances. Don't expect any bells and whistles with this option.

- Deluxe: If you are ready for more, the Deluxe program helps you customize your budget, track your debt, manage your debt, and monitor your investments.

- Premiere: The top tier program includes everything in Deluxe, plus online bill pay service (free of charge) and quicker access to customer service.

Quicken offers two ways to contact customer support:

- Phone support is available Monday - Friday, 5 AM to 5 PM Pacific Time

- Live chat is available 24/7; you can see the wait time for an agent right on the website

What Are the Fees?

As we discussed above, Quicken is a subscription-based service. You will pay anywhere from $34.99 to $74.99 per year for the service. If you neglect to renew your subscription, you can still access your information, but you cannot use the program's services any longer.

Previously, Mac users had to run Quicken for Windows via VMWare Fusion or run an old version of Quicken for Mac. This allowed them to run Quicken on a Mac without having a program made for Mac. These users who now pay for the Quicken for Mac subscription can move their Quicken files over to Quicken for Mac. Quicken does offer full support to help you transfer the files, no matter how many years of transactions you have going at the time of transfer.

Reasons We Like Quicken for Mac

- You can sync your financial data between the desktop app and the mobile app. The Quicken mobile app is free and syncs with your desktop app. This way you can add, edit, or delete transactions on either device and they will synchronize the information so you are always looking at the most up-to-date data.

- You can easily reconcile your accounts. If you don't reconcile your accounts, you may be using incorrect information. Reconciling is a feature in Quicken for Mac that is simple to use. It's like a system of checks and balances that lets you know the information you put into Quicken for Mac matches the information the bank provides.

- Quicken for Mac provides visually appealing graphs and charts. Quicken for Mac is easier to navigate and read for users. You can view ledgers, graphs, or charts—whichever is the most appealing to you and will help you stay on track with your budget.

- You can pay bills via Quicken for Mac. Quicken for Mac has access to more than 11,000 vendors. You can view all of your bills on the dashboard and/or you can download your bills in PDF format if you prefer to have a copy of the bill yourself.

- You can manage your investments. A new key feature of Quicken for Mac is the investments feature. You can track your portfolio, get updated quotes, and track your profits. You can also see your cost basis, determine your capital gains, and prepare yourself for tax time.

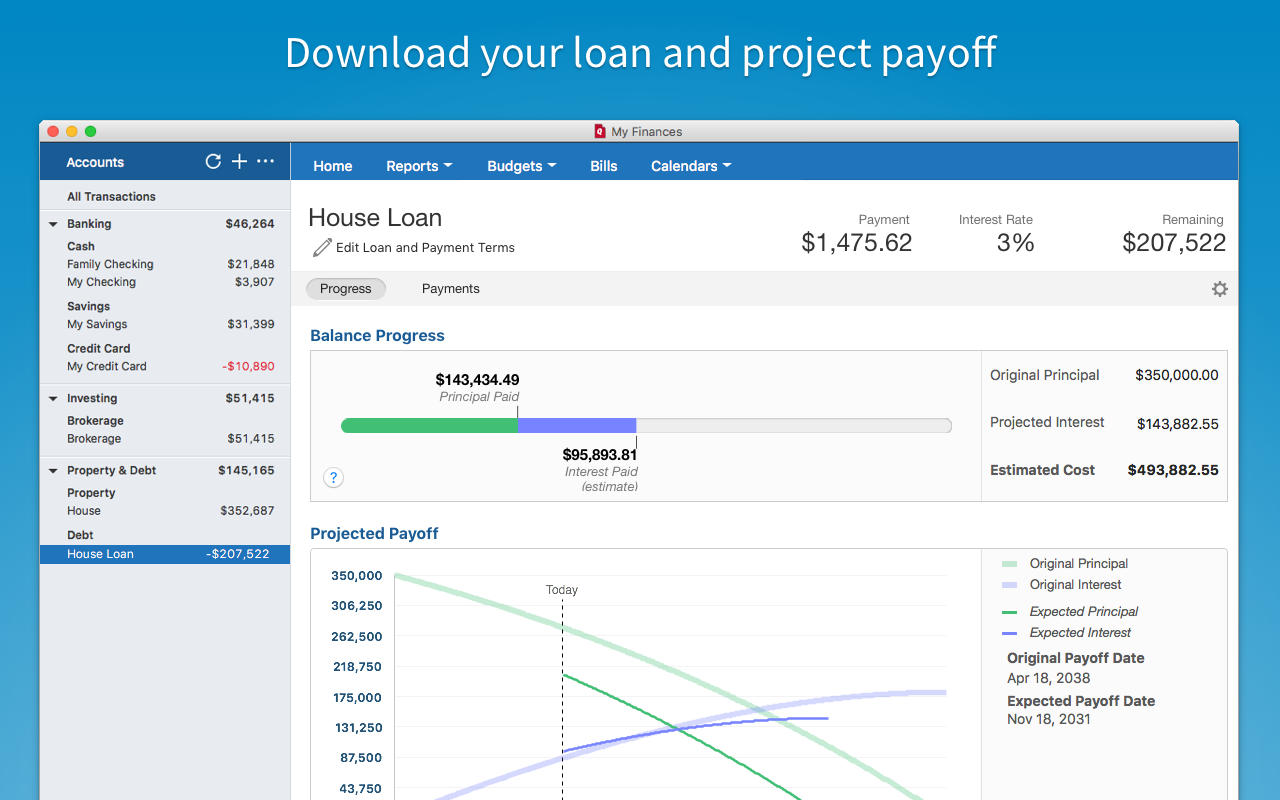

- You can track your principal and interest on loans. If you are trying to get ahead of your loans, you will like the loan feature in Quicken for Mac. You can see how your payments affect principal and interest. You can also run 'what if' scenarios to see how different payments and scenarios would help you pay off your debt.

- You can use Dropbox for backups. Even though Quicken for Mac is on your local computer, you get access to 5 GB of online backup from Dropbox. This gives you a 'backup' of your financial information to ensure that you don't lose anything.

- You always have the latest updates. Because Quicken for Mac is subscription-based, you don't have to upgrade the product when new versions are released. You'll automatically receive updates, which means you'll always have the latest features available to you.

- You don't lose access to your financial data even after your subscription ends. If you don't want to renew your subscription, you still have access to your financial data. You can view it, edit it, or export it. While you can't use Quicken's features, you won't lose the information you collected while you did pay for the program.

- Quicken supports more than 14,000 financial institutions for automatic update of your financial information. This is the same number of financial institutions Quicken works with for the Windows version, so Mac users are on the same wavelength as Window users in that regard.

Quicken Deluxe 2017 For Mac

Reasons You May Want to Look Elsewhere

- There is little difference between the Premier and Deluxe versions. The only differences are the online bill pay (free of charge) and faster priority for customer service. For many users, that may not be worth the extra $30 per year, especially when most banks offer free bill pay.

- Investment reporting still lacks features offered in Quicken for Windows. While Quicken for Mac 2018 has dramatically better investment features, it still pales in comparison to Quicken for Windows' features. The main features that lag are in terms of reporting, which is the one feature many users want when looking at their investments.

- You have to pay for it every year. Quicken for Mac used to be a native program that you downloaded to your computer and used for as long as you wanted. If you wanted to use an old program, that was your prerogative. Now you don't have that choice—you have to pay the subscription fee or you can't use Quicken for Mac.

How It Compares

QuickBooks for Mac: QuickBooks for Mac offers similar features to Quicken for Mac, but QuickBooks also caters to small businesses. Quicken is more for personal finance use. If you don't manage payroll or your business has simple financing needs, Quicken may suffice. Businesses that need more robust financing options, though, may do better with QuickBooks for Mac.

Quicken for PC/Windows: While Quicken for Mac made many improvements for 2018, it's still not the mirror image of Quicken for Windows that many users want. The navigation in the Windows version is still easier. Also, the reporting options in the Windows version are more robust.

Bottom Line

If you can overlook the subscription fees for Quicken for Mac, it does pack quite a punch being a native program for Mac users. While it does lack certain features, it's a major improvement over the previous versions.

With the subscription-based service, you do have the benefit of quick fixes when issues arise and always having the latest version at your fingertips.

More from CreditDonkey:

|

|

|

Retail or quicken.com purchasers should be able to update today. Mac App Store customers will have to wait for a bit as we go through the App Store review process. We won't make the cloud changes until we're sure most people have upgraded.

Please post any issues with this release as comments in this forum post so we can spot them quicker. We'll be monitoring this post.

NOTE: We just released v4.4.3 so please upgrade and post any new issues on that forum post.

Quicken

Comments

Intuit Quicken For Mac 2017 Review

- edited August 2018I upgraded from Quicken 2007 in August of 2015. Is it worth it upgrade again to Quicken 2017???

Thanks - edited January 2017

This should be a question in a separate thread as this has nothing to do with the above post.I upgraded from Quicken 2007 in August of 2015. Is it worth it upgrade again to Quicken 2017???

Thanks

If you find this reply helpful, please be sure to click 'Like', so others will know, thanks.

(Canadian user since '92, STILL using QM2007)

Have Questions? Check out these FAQs:- Quicken Windows FAQ list

- Quicken Windows FAQ list

- edited January 2017I upgraded to Quicken 2017 4.4.2 today. Now my Wells Fargo information won't sync. 4.4.1 worked flawlessly. Quicken can connect to Wells Fargo without issues so there's no password or internet issues. The information from my checking and savings accounts just won't port into Quicken.

- edited January 2017My QM2017 4.4.2 (updated from v4.4.1) syncs reliably with my WF accounts (checking, savings, & cc) via Quicken Connect.

- edited January 2017It seems to be working now. Must have been a one off issue.

- edited March 2017My 4.4.2 update is downloading painfully slow. Did the whole modem reset with the IP. Back to 100+Mbps and still 32MB download taking 20 minutes? Any ideas welcome.

- edited March 20172 things are not working for me with 4.4.2

1) Dragging a transaction to manually match doesn't work anymore. I get a cursor indicating this item can't be dropped here as I move it. There is a fine line under the matching transaction where the cursor changes and allows me to drop but the match doesn't work. There is no way to manually match transactions now!

2) In the calendar view I used to be a be able to double click on a scheduled transaction to go to that transaction but double clicking no longer does anything.

Can I go back to 4.4.1, this is very annoying. - edited January 2017

OK, now the matching is working. Don't know what changed. I clicked around and selected different transactions, seemed to fix something.2 things are not working for me with 4.4.2

1) Dragging a transaction to manually match doesn't work anymore. I get a cursor indicating this item can't be dropped here as I move it. There is a fine line under the matching transaction where the cursor changes and allows me to drop but the match doesn't work. There is no way to manually match transactions now!

2) In the calendar view I used to be a be able to double click on a scheduled transaction to go to that transaction but double clicking no longer does anything.

Can I go back to 4.4.1, this is very annoying. - edited April 2018I'm having an issue with 4.4.2 for Mac - my budget has not pulled in actual downloaded expense transactions that are split between categories. What's interesting is that my budget IS pulling in actual downloaded income transactions that are split (e.g. paycheck), but excluding the expenses (e.g. Home Insurance). Is there a resolution for this?

- edited March 2017Was using Quicken 2015 on my Mac, upgraded to 2017. Some WF Bank transactions in different accounts do not download. Really frustrating. I've deactivated and reactivated the link and still the same transactions did not load. If I have to manually check through every transaction, what's the point? Help in resolving this would be greatly appreciated.

- edited December 2017My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

If you're happy with what you have then I wouldn't necessarily upgrade. Take a look at what's been added since 2015 to decide. Check out our website at https://www.quicken.com/mac.I upgraded from Quicken 2007 in August of 2015. Is it worth it upgrade again to Quicken 2017???

Thanks - edited January 2017

There is literally one little thing that's different between 4.4.1 and 4.4.2 which is centered around a specific error message that is returned when syncing and this shouldn't affect anything until we make a change on the service. In other words, nothing should work differently between 4.4.1 and 4.4.2.2 things are not working for me with 4.4.2

1) Dragging a transaction to manually match doesn't work anymore. I get a cursor indicating this item can't be dropped here as I move it. There is a fine line under the matching transaction where the cursor changes and allows me to drop but the match doesn't work. There is no way to manually match transactions now!

2) In the calendar view I used to be a be able to double click on a scheduled transaction to go to that transaction but double clicking no longer does anything.

Can I go back to 4.4.1, this is very annoying. - edited January 2017

Were you on 4.4.1 before? We didn't change anything in budgets so there shouldn't be any difference between the two. Possibly Quit the app and restart to see if the issue continues to happen. Also double check that the category of the item you are budget is turned on in your budget. Not all categories automatically appear in the budget.I'm having an issue with 4.4.2 for Mac - my budget has not pulled in actual downloaded expense transactions that are split between categories. What's interesting is that my budget IS pulling in actual downloaded income transactions that are split (e.g. paycheck), but excluding the expenses (e.g. Home Insurance). Is there a resolution for this?

- edited January 2017

@quickenMarcus, then any thoughts on what's happened with WF for me here? Worked fine last weekend with 4.4.1. Now, no error notification, no transactions uploaded or downloaded, just the normal message 'No transactions downloaded' and the error 400 in the log. The submittal it's responding to involves a description change for a payee.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

Again, this is probably nothing related to 4.4.2 since nothing changed in this area between 4.4.1 and 4.4.2. My hypothesis is that Quicken is displaying what we're receiving from the bank. If you are using Direct Connect, we get what the bank sends us. If you're using Quicken Connect, we're displaying what the account aggregator sends us. I would check your logs or work with our support team to review the logs. You can get to them by using the Help menu item called Show Logs in Finder. This will tell you where the issue resides. If the logs don't show the missing transaction then the issue is with the bank/aggregator and not Quicken Mac.Was using Quicken 2015 on my Mac, upgraded to 2017. Some WF Bank transactions in different accounts do not download. Really frustrating. I've deactivated and reactivated the link and still the same transactions did not load. If I have to manually check through every transaction, what's the point? Help in resolving this would be greatly appreciated.

- edited January 2017

So, looking at the log, I see that the Payee name has an ampersand in it. Always has, but because I changed the description field, Q apparently needs to resend the payee up to Wells. But in the OFX, the current version (no idea when/if this changed) is not escaping the ampersand with '&'. So it's indeed an ill-formed OFX submittal, and Wells is properly rejecting it. (Although the error reporting is abysmal here)My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request

So I have no idea how to proceed, as Q won't let me edit the name of an existing payee; I've tried putting the description field back, but Q just submits it again with the revised description. I tried creating a new payee with 'and' instead of &, and then merging them, but Quicken uses the old name for the merged entry (saying happily 'and you can rename it after merging if you want a different name', which is false, btw).

Suggestions for how to recover?

Edit: and yes, the fact I changed the description at the same time as migrating to 4.4.2 means this is probably independent of that. - edited January 2017

Given that there are a bunch of Wells Fargo issue being reported, my guess is that something changed at Wells Fargo or with our account aggregator for Wells Fargo. Again, there's nothing in 4.4.2 that would affect only Wells Fargo and no other bank. I would try to update again to see if the issue gets resolved.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

Sorry just read the most recent post. Let me investigate more.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

hfm. We investigated and you nailed it on the head and uncovered a bug. We're going to fix it but the fix won't make it to customers until probably February. The bug is in the Payee modification call. It should escape the ampersand but doesn't. Creating a new payee is fine and since most people don't change their payees, most don't run into the issue and of course, even a smaller subset have '&' in their payee name. I think the only workaround, for now, is to create a new Payee. Use that to pay bills and then merge that payee with the existing one after we fix the bug. Will that work for now? I can't think of another workaround.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

Good to hear! I did more or less that, and I'm clear for now.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

That's great to hear. Thanks for tracking it down which made it easy for us to confirm the issue and fix it.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited January 2017

You probably already did this but Quitting and starting Quicken again may help. Sometimes there could be issues with our servers regarding load during peak times so trying at a different time may help. I don't see any issues with our servers on our internal dashboard but let me know if this continues to be slow for you.My 4.4.2 update is downloading painfully slow. Did the whole modem reset with the IP. Back to 100+Mbps and still 32MB download taking 20 minutes? Any ideas welcome.

- edited January 2017

Yes, I was on 4.4.1 before without this issue. I just quit the app and restarted my computer. After synching Quicken once I restarted, the problem did not fix itself. One thing to note after reviewing other issues in this thread is that the expense transactions in question are from my Wells Fargo checking account with a Direct Connect connection type. I confirmed the categories in question are included in my Budget and I can see that the categories are correctly allocated on the transaction itself.I'm having an issue with 4.4.2 for Mac - my budget has not pulled in actual downloaded expense transactions that are split between categories. What's interesting is that my budget IS pulling in actual downloaded income transactions that are split (e.g. paycheck), but excluding the expenses (e.g. Home Insurance). Is there a resolution for this?

- edited January 2017

I just posted in the other thread but wanted to post here to close out. The details of the split included the details of a transfer to another account not included in my budget. When I removed the link, it allowed Quicken to show the expense in my budget.I'm having an issue with 4.4.2 for Mac - my budget has not pulled in actual downloaded expense transactions that are split between categories. What's interesting is that my budget IS pulling in actual downloaded income transactions that are split (e.g. paycheck), but excluding the expenses (e.g. Home Insurance). Is there a resolution for this?

- edited January 2017

I was going to put this into a reply once a new thread was created but I guess I'll put it here.I upgraded from Quicken 2007 in August of 2015. Is it worth it upgrade again to Quicken 2017???

Thanks

Right...there is not a lot that is new in QM2017 vs QM2007. I suggest that you make sure that Quicken 2017 for Mac will meet your needs, since it is not an upgrade from QM2007 but rather from Quicken Essentials (which was re-written from the ground up, starting in 2010), so there are some features that are still not there e.g. loan amortization, 2-line display, QuickMath, or are not as fully developed yet, e.g. Customized Reports, investment lot management, performance reports and stats (therefore some data may not carry over). You can start here:

http://www.quicken.com/mac/compare

Currently, the main advantages of QM2017 over QM2007 include the ability to sync cash, bank, and credit card accounts using Quicken Mobile for mobile devices (iOS and Android) and the ability to save receipts with transactions via computer or mobile device. There are a few other minor features that QM2007 does not have. Note that QM2017 is being supported until April 30, 2020 whereas it has been announced that security fixes have ceased for QM2007 since QM2017 is released...see http://www.quicken.com/support/update-quicken-mac-2007-support-policies-may-2016 yet online access will continue as long as the FI/Bank supports it and their security updates don't prevent it.

You may want to review the List of Obstacles and Hindrances for Migrating from QM2007 or QWin to Quicken for Mac. Add your vote to any features that are missing for you.

Be aware of data that will and will not carry forward:

https://www.quicken.com/support/what-data-gets-carried-over

Then look at the updates since the original release here:

https://www.quicken.com/support/quicken-2017-mac-release-notes

Also read some of the Fixes and Improvements that are being released soon here:

http://www.quicken.com/upcoming-product-fixes-and-improvements

You will also want to look at a more detailed comparison done by a SuperUser which also identifies nuances not mentioned elsewhere (and read on for comments from other users too on that same discussion thread):

https://getsatisfaction.com/quickencommunity/topics/can-anyone-who-has-switched-from-2007-to-2015-he...

Take a look at the following videos to give you a better idea:

https://www.youtube.com/user/QuickenMac

If you find that QM2017 does not meet your needs, the alternative is to continue to run QM2007 Lion Compatible (LC), which will run on Mac OS X 10.6.8 to 10.12 Sierra (so far).

(If you find this reply helpful, please be sure to click 'Like', so others will know, thanks.)

If you find this reply helpful, please be sure to click 'Like', so others will know, thanks.

(Canadian user since '92, STILL using QM2007)

Have Questions? Check out these FAQs:- Quicken Windows FAQ list

- Quicken Windows FAQ list

- edited January 2017

hfm, we fixed this issue and are going to release an update early next week. Thanks again for helping us track down this issue. I think it's been in the product for a long time so not many people have hit it but it's important to fix.My Wells Fargo is not syncing at all with 4.4.2; all my other accounts look like they synced fine. Strangely, no error is reported, and the Account Status window shows 'Last Connecton Successful', but with last weekend's date (when I last used Quicken).

I tried quitting and redoing it, no luck. The log shows:

2017-01-16 21:41:51 +0000: Response encoding: (null), length: 11, MIME type: text/html, and statusCode: 400

2017-01-16 21:41:51 +0000: HTML error 400 from server:

Bad Request - edited April 2018

Thank you for the update. Yes, we don't currently support transfers in a budget but we know people want to track them for things like mortgage payments and moving money for savings. It's definitely on our long-term roadmap for budgets.I'm having an issue with 4.4.2 for Mac - my budget has not pulled in actual downloaded expense transactions that are split between categories. What's interesting is that my budget IS pulling in actual downloaded income transactions that are split (e.g. paycheck), but excluding the expenses (e.g. Home Insurance). Is there a resolution for this?

- edited January 2017installed 4.4.2 all my accounts sync except 1 of 3 for security service federal credit union. my checking won't sync says its a dead account, I can login so its not dead my 2 other accounts at ssfcu were working fine , now has error 105 no syncing, tried to stop downloads on checking and restart it up now it won't communicate error 105 an error between quicken and ssfcu in communication. I login thru this link https://mybranch.ssfcu.org and yours is https://www.ssfcu.org can this be in issue I can log in both sites Really sucks cause this is one of my bill pay accounts

- edited January 2017Cannot update. Continuously get 'relaunch' error. Have re-installed Sierra, even started in safe mode. No difference.